Fiber Buildouts in 2017– A Look at Fiber Deployment Trends, Challenges, and Opportunities

In 2016, the Organization for Economic Co-operation and Development (OECD) ranked the US as having

the highest number of broadband users in the world, but the US still ranks low (#22) in fiber adoption, lagging

behind countries such as Japan and South Korea. Even considering the number of fiber initiatives that are

bringing lightning-fast connections to a number of cities across the nation, broadband infrastructure is still lacking, most notably in rural areas.

In fact, today a mere 11% of US broadband subscribers receive their services over a fiber connection. Lacking access to fiber-based connectivity is more than just an inconvenience. A 2016 research report, "The Impact of Broadband and Related Information and Communications Technologies on the American Economy", references a study that shows that areas with access to broadband had stronger job gains and business growth than those that did not.

As we look into 2017, we continue to witness the growing demand for bandwidth as the primary driver for fiber buildouts. The continued surge of mobile computing devices, bandwidth-intensive online activities, such as streaming high-definition video, "anytime, anywhere" mobile broadband access, and the Internet of Things (IoT) all help to ensure that the demand for fiber connections will continue to increase and, eventually, we believe fiber will replace slower, copper-based connections.

With these trends come both challenges and opportunities.

The Realities

The rampant growth in data traffic on smartphones, tablets, and other mobile devices, creates demand for fiber, not just in the big cities, but across the country. From large commercial complexes and sprawling university campuses to small office buildings and neighborhood schools, fiber network upgrades are in full swing. The good news is that more schools and educational facilities qualify for E-rate funds to pay for such upgrades, thanks to changes in federal regulations regarding dark fiber eligibility. Additionally, Fiber-to-the-Home (FTTH) initiatives are escalating and inspiring grassroots efforts by subdivisions, small towns, large towns, and states, to build their own fiber networks to support the local community.

The ongoing surge of mobile computing devices, bandwidth-intensive online activities, "anytime, anywhere" mobile broadband access, and the IoT, all help to ensure that the demand for fiber connections will continue to soar.

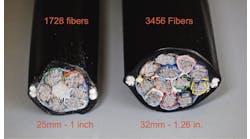

Fiber buildouts in metropolitan areas continue to increase as service providers seek to enhance their network reach in order to better serve bandwidth-intensive industries including financial services, education, healthcare, hospitality, government, retail industries, and the like. When building new fiber plant, service providers are deploying larger fiber counts than ever before in order to future proof their investment. In fact, where 864-fiber-count had been the largest cable that service providers typically deployed in the past, we are now seeing fiber counts in the thousands being deployed in major metropolitan areas, such as New York. While we have seen this trend in the last 5 to 10 years, we expect it will continue to be among the hottest trends for 2017.

FirstLight Fiber is a fiber-optic bandwidth infrastructure services provider operating in New York and Northern New England. Recently, we successfully completed many fiber projects, including cell tower backhaul networks for major wireless providers. And we are seeing consistent demand for high-capacity, fiber-based services in the New York and Northern New England metro areas with business customers as well. Expanding our network continues to be a strong focus for us, and we expect to accelerate metro fiber build-outs by adding 30%-50% more network in 2017 alone.

The Challenges

As with all popular industry trends, they often come with challenges. What hurdles will we face along the way?

When it comes to fiber builds, we are seeing a couple of things in the industry. First, there is an anomaly in the way we are building out fiber and where we are building it. As a result of customers’ shift in preference from just leasing lit bandwidth to requesting that their services be delivered over a dark fiber network, we are seeing a shortage in availability of fiber resources. This is forcing service providers to conduct detailed, long-range buildout forecasts to know where and when it will need the fiber, and to incorporate long production lead times into its deployment schedule so that the fiber will be onsite where and when needed so that the provider can meet its installation date.

The reason for fiber shortages? The demand for fiber has increased as a result of growing bandwidth trends, as well as the introduction of new market entrants with FTTH initiatives.

While many of these new entrants have good expansion claims, it is interesting to note that some may be overestimating the ease at which fiber build-outs occur, as evidenced by Google Fiber’s recent issues with pole attachments, as reported by Fierce Telecom. While the city model opens the doors freely to new market entrants to build in the metro, the reality is that there are fair access laws, which set the price, procedure, and timeline for access to the resources that these providers need to build out their networks. We have seen many examples, like the one cited above, where new entrants to the fiber market believe that they can enter a municipality and dictate their own terms when it comes to accessing shared rights-of-way and resources.

What is perhaps one of the biggest challenges facing these new entrants is one that facilities-based CLECs have been struggling with for years. The licensing and permitting process continues to pose major challenges to building out fiber in smaller, more rural markets. These builds come with hefty recurring fees that a provider has to factor into its pricing model.

Also, it is a complicated process to obtain licensing from municipalities. Just to complete the paperwork to the municipality’s satisfaction is a task, given that each municipality may have its own process and paperwork. However, some states, such as Vermont, are attempting to make positive changes to this process in order to make it less difficult — and with that, we should see greater opportunities for fiber builds.

The Opportunities

Groups like INCOMPAS (http://www.incompas.org/), the Washington-DC-based industry association representing competitive communications service providers and their supplier partners, are working behind the scenes to help address many of the challenges that service providers face such as market equality and access to shared resources.

Additionally, we know there is an opportunity among the industry players, big and small, to cooperate and work together to make these builds happen. While we all compete against one another, we also must come together and leverage each other’s strengths to shorten the daunting timelines for these builds and make broadband a reality across the US.

Even considering the challenges that we face in 2017, we expect this industry to remain focused on building Last Mile fiber. While problems with fiber availability exist, there is no shortage of demand for high quality, broadband, fiber-based services.

What matters most is that the fiber-based service providers are meeting this demand by supplying broadband services where and when customers need them. With improved access to direct fiber connections and the move away from copper and PON-delivered networks, dedicated network fiber is providing both improved quality and lower latency across US markets, which can only mean good things for our communities and our economy.

Sources:

http://www.ecmag.com/section/2016-fiber-update

Hassett K, Shapiro R (2016). "The Impact of Broadband and Related Information and Communications Technologies On the American Economy".

https://www.statista.com/chart/4392/fiber-adoption-in-oecd-countries/

http://www.fiercetelecom.com/telecom/google-fiber-s-nashville-pole-troubles-catches-mayor-s-eye-but-are-at-t-comcast-willing-to

Save

Save

Save