Ready for the Green Flag:

It seems like Network Functions Virtualization (NFV) has been a hot topic for a few years, yet we haven’t seen many service providers pull the trigger on large-scale deployments. The benefits for providers and their enterprise customers are clear, so why aren’t we progressing faster?

This is a legitimate question, and it has some reasonable answers. Before we address them, and assess how and when the industry will move towards widespread NFV use, let’s look first at the problems it solves and why it was developed in the first place.

As analyst firm ACG Research points out, "Adopting NFV brings the promise of eliminating rigidity in operations based on legacy, purpose-built platforms that are too slow to evolve and too costly to run. Moving to more elastic, software-driven, openly architected and economically designed platforms will be a key element in (service providers’) transformation."

NFV replaces dedicated network devices with software running on general-purpose standard servers as virtual machines. Network functionalities can be placed at any network or customer site, wherever it is most efficient, and network resources can be easily relocated to suit rapidly changing needs.

For carriers, NFV promises new ways of delivering services, including services they were never able to offer before, in a more agile, flexible way. Since these systems are primarily software-based, it reduces their dependency on traditional suppliers while at the same time lowering costs.

"According to operators worldwide, it is not CapEx savings that primarily motivates them, since the top reason to deploy NFV is to create a new agility in their operations and networks that allows them to quickly bring new services to market for new revenues," stated Michael Howard, Senior Research Director and Advisor, Carrier Networks, at IHS Markit. "Operators also believe that operational efficiencies will be gained with centralized, software-driven control to deliver services across their multi-domain, multi-layer, multi-vendor networks."

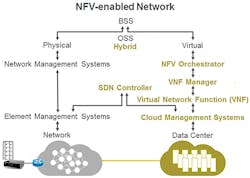

Traditional customized networking equipment has its advantages, but it restricts providers to a few specific suppliers. By giving carriers the option of using software from different vendors, it creates beneficial competition. Service providers may use the hardware from one vendor, an operating system from another vendor, and virtual network functions software from a variety of independent developers. (See Figure 1.)

Figure 1.

This does create some multi-vendor management challenges for service providers that they didn’t face with single, turnkey network vendors. This challenge is perhaps more complex than originally anticipated, accounting for a slightly slower pace of NFV adoption, despite the advantages of the technology.

Who Is Drafting Off of Who?

In addition to the advantages of competitive capabilities and reduced cost that carriers can gain through NFV, the top benefit both for them and their business customers is a drastic reduction in the time it takes to deploy in a virtualized environment. Enterprises get the services they want quickly, and carriers start earning revenue right away.

This is the advantage of service agility, with ACG Research noting that "Virtualization can help a digital service provider react to the market dynamics quickly. It can introduce customized as well as innovative solutions to address larger market segments."

Services can be certified, launched, and delivered rapidly when the underlying service foundation is primarily software. If an enterprise customer wants a particular service, that customer would no longer have to wait weeks or months before that service goes live; it could be a matter of hours or even a few clicks.

The same is true for connecting a new customer to a virtualized service. The number of truck rolls is reduced to zero when a provider can remotely instantiate a new software-based application to the customer premises equipment. Providers can offer self-service portals where an enterprise could buy services with an absolute minimum of contact with the provider. (See Figure 2.)

Figure 2.

One thing that will spur the deployment of NFV is the flexibility that vendors are able to supply in their hardware and software. Already, leading vendors are introducing modular equipment conceptually not unlike Lego blocks in their ability to be assembled and used in all types of use case scenarios. Open systems, with the ability to run any software and operating system on the hardware, are the key.

For enterprise customers, services not only can be launched more quickly, but service packages that once were simply too complex for a provider to offer can now be made available.

Even better, enterprises could easily be allowed to try a service out for a time before buying it. This would have been impossible in an architecture based on physical connections and hardware, since the enterprise’s commitment to the service would be required before the work began. Now the commitment can come at the end, once the service has been sampled. Should the enterprise decline the service, it’s not a big deal since the cost of launching it is minimal.

When Is the Wave Around?

What you are seeing now in terms of NFV is just the smallest tip of the iceberg. In just the last couple of years, the numbers of proof of concept demonstrations and service providers’ requests for information (RFIs) have gradually been increasing. Then in the second half of 2016 we began to see more traction. The number of requests for actual proposals and for quotes from vendors increased significantly. Most importantly, several top service providers internationally started rolling out new NFV-enabled solutions for wireline and wireless markets.

Virtual customer premises equipment, or vCPE, is considered a primary NFV use case. This involves virtualizing and possibly relocating the functionality associated with conventional CPE (and value-added services) to other locations in the network, wherever those functions are performed most efficiently. This is a key development in the ability to leverage NFV for enterprise business services.

The industry has been through a long learning curve, and there have been pushbacks. For the carriers, they need to evolve the knowledge of their networking staffs from a physical to a virtual architecture. Frankly, many hardware vendors are also virtualized network function (VNF) vendors, and are working to protect their revenue from selling appliances. They may have a higher profit margin in software, but are concerned that the transition to NFV will reduce their overall revenues and remove customary barriers to market entry.

"Operators see two main barriers to introducing and deploying NFV," noted Michael Howard of IHS Markit. "Only some software and solutions are carrier grade — although it is solid enough for proofs of concept and limited field trials, and they see challenges in integrating NFV and virtualization into their physical networks and operations."

Analyst Jim Metzler of Ashton Metzler Associates found in a survey of service providers a few key areas of resistance to implementing NFV. Among them were concerns about end-to-end provisioning that mixes physical and virtual resources, the lack of a compelling business case, and the need to upgrade employees’ skills.

Metzler said as providers seek that business case, they must focus more on the outcomes of the advantages of agility and speed; those outcomes are additional revenue, improved margins, higher service adoption rates, reduced churn, and other benefits.

Many carriers have already started deployment of NFV-powered solutions, including the first commercial services with various vCPE implementation options. NFV is on the march, bringing with it jockeying among vendors of hardware, software, virtual network functions, and operational and billing support systems. It’s an interesting time, and clearly the industry is moving in the virtual direction.

Industry numbers show that carriers have invested as much as $5 billion on NFV to this point, and IHS Markit anticipates a $29 billion relatively mature market by 2020. About half of that 2020 spending is predicted to be in the form of outsourced services for NFV projects, with 42% in the form of NFV software. The remainder of the spending would be on hardware such as servers, switches, and storage.

While it may seem that NFV has moved slowly, it really hasn’t. When compared with other major telecommunications industry disruptions, it is actually moving pretty quickly. It took two decades for mobile technologies to go mainstream, and even longer for the Internet to evolve from concept to mass acceptance. NFV was developed only in 2013 and is poised to transform networks on a large scale within a year or two.