How Wi-Fi Offload, Onload Can Help —

Today, service providers need to implement data offload and onload to address network congestion, namely overburdened core network elements and cell site specific congestion.

For mobile operators, offloading to Wi-Fi (Wireless Local Area Network) or small cells provides them with a greater opportunity to seize market share and revenues from fixed line operators, to extend their reach beyond the mobile market, and to make their 4G business case profitable.

Operators need to view offloading as a complementary solution, along with their 3G/4G network, to ease network congestion. And clearly, offloading must be and will continue to be complementary with the evolution of the 4G/5G market.

Operators can deploy their own public Wi-Fi hotspots, as AT&T has done in the US, then pre-install the connection manager software on customers’ smartphones so when the phones detect networks in such hotspots, a seamless connection is established to Wi-Fi for data. The availability of widely deployed Wi-Fi networks provides network operators with a good value proposition, especially when 80%-90% of data consumption occurs indoors.

Offload Versus Onload

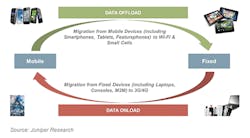

Juniper Research has considered 2 different aspects of data migration for the purpose of this article. The first is from mobile devices to the fixed network, which is data offload. The second is from fixed devices to the mobile network, which is data onload. (For more detailed descriptions, please see the sidebar "What’s the Difference?")

It is important for network operators to be cognizant of the net impact that both offload and onload have on the total data traffic through the network.

We recognize that even though data offload alleviates some of the operator’s network congestion by using microcells, a significant proportion of the offload could be offset by fixed to mobile migration of data, as demonstrated in Figure 1.

Figure 1. Data Migration From Mobile to Fixed and Fixed to Mobile

In our primary research, we asked respondents for their views on the factors driving this data growth. (See Figure 2.) The major aspects and challenges include:

• Mobile device penetration rates and growing data traffic demand; alongside affordable 4G devices and services.

• Increased competition between operators.

• The "stay connected" trend (anytime, anywhere) and the continued rise in video data traffic volumes.

• New device and content adoption driven by advances in augmented reality (AR) and virtual reality (VR) technologies.

Figure 2. Cellular Network Data Growth Factors

Flatlining Revenues and Declining ARPUs

Global Average Revenue per User (ARPU) levels have followed a downward trend in recent years. The decline in certain regions is exaggerated in some cases because of the depreciation of local currency bundles against the dollar (e.g., in Latin America and Europe), but the implications are clear.

On a global basis, the dollar value of operator-billed monthly ARPU fell by 59% between 2005 and 2015, to $10.46. Levels in North America have remained the most buoyant due to a variety of factors, including limited prepaid migration and strong uptake of smartphones/data bundles. Indeed, 2015 ARPUs in North America were still significantly higher than their 2005 equivalent in West Europe.

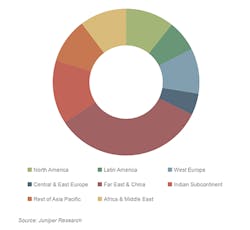

That said, mobile data traffic continues to grow at an unprecedented pace, driven primarily by video usage. The increased number of mobile subscriptions, smartphone usage, and app availability, have resulted in an increase in data usage per mobile device user, as indicated in Figure 3.

Figure 3. Total Data Traffic Through the Cellular Network Per Annum (PB) Split by 8 Key Regions 2018: 129,000PB

Most handsets in many developed markets are now smartphones, with just under 5 billion smartphones forecasted to be in use in 2021. This is a Compound Annual Growth Rate (CAGR) of 10.9% globally throughout the forecast period. With the period of explosive growth in the Chinese smartphone market closing, the best areas for growth in the future are India, developing areas of the rest of Asia-Pacific, and Africa & Middle East.

Driven by the high resolution and frame rates required for VR, the technology is likely to require significant bandwidth requirements; YouTube estimates that each frame of 360˚ video requires 4-5 times the bandwidth of traditional video. However, due to the home-based nature of typical VR use cases, alongside speed and latency requirements, this is likely to mean an uptake in Wi-Fi and fixed line broadband provision rather than an opportunity for MNOs to increase mobile data revenues.

Second Screening

Whilst video and social media have seen ties for some years, there has been a long running trend for the use of social media to discuss and comment on TV and video, as well as second screening (the use of a second device (i.e., smartphone), while viewing content on another screen). However, with increased access to broadband services, as well as improved data speeds, this has now extended to include the uploading and sharing of video, as well as live streaming.

The delivery of content to consumers who are away from home has always been an issue for OTT streaming providers, with these players often using cellular data to stream content. As we see greater consumption of HD programming and, ultimately, as 4K capable devices filter through, care of data usage will be paramount.

Juniper Research has recently conducted several studies which enable us to forecast the scale of the data explosion challenge. Therefore, Juniper forecasts total mobile data traffic growth through the mobile networks based on our database of device penetration, data usage by application type (including video, music, messaging, browser, etc.), and others, including device installed base, by considering 2 aspects of data migration: from mobile to fixed, and from fixed to mobile.

Juniper estimates that total cellular traffic will increase from an estimated 129,000 in 2018 to exceed 318,000PB (Petabytes) in 2021, a CAGR of 35% over the period.

It is also worth noting that despite operators introducing data caps, they are constantly increasing the monthly data allowances for the same price, contributing to more data usage per month.

Interestingly, the users’ need for data traffic will increase even faster, so operators that do not deploy Wi-Fi will risk taking an even smaller share of the users’ traffic.

[toggle title=”What’s the Difference?” load=”hide”]Data Offloading

Data Offloading helps to move mobile data traffic from one network to another by using complementary network technologies for the delivery of data via cellular networks. It enables network operators to reduce the congestion in the cellular networks, while for the end-user it provides cost savings on data services and higher bandwidth availability.

The 2 main network technologies used for mobile data offloading are:

1. Wi-Fi

2. Small cells including microcells, picocells, and femtocells.

Operators also use Distributed Antenna Systems (DAS) for both indoor and outdoor data offload. And while it is comparatively expensive to deploy, it forms a network of antenna nodes to extend coverage and reliability.

By offloading mobile data traffic onto available complementary networks, operators can optimize the available network resources and reduce the bottlenecking of services, thereby allocating their network resources to other users.

Data Onloading

This is data migration from fixed to mobile. This is the data through the cellular network, via mobile broadband dongles or 3G/4G cards, from devices such as 3G/4G enabled notebooks, PCs, game consoles, and other machine-to-machine (M2M) devices, whose primary mode of connectivity is fixed. A good example of onloading is when a user connects his/her game console online via a USB 4G modem.[/toggle]

Save

Save

Save

Save

Save

Save

Save

Save