3 Models for Deep Fiber Deployments —

Fifth generation mobile networks (5G) are now poised for field testing and launch worldwide. Wireless networks were at a similar inflection point as 4G services launched early in the decade. The US took action as government made new spectrum available, and carriers responded to accommodate radical, twentyfold growth in global mobile traffic. The massive investment in wireless network infrastructure rewarded the US consumer with more coverage at affordable prices, and the US economy generated up to 700,000 jobs as a result.

An equally transformative moment is coming with 5G, but with 2 important differences. First, the economic stakes are potentially higher, where connected devices, applications and business models could dramatically stimulate economic productivity. Second, the US is not as well prepared to take full advantage of the potential, lacking needed fiber infrastructure close to the end customers (deep fiber).

5G wireless has a wireline pulse. While 5G standards focus on a new generation of technology and capabilities for speed and flexibility, the lifeblood of its potential will come from the wireline network with the ultimate goal to extend deep fiber into the network near the customer.

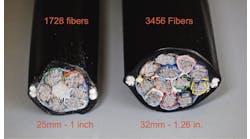

Carriers will deploy many more small cells, homespots, and hotspots in higher bands, with a coverage radium measured in meters versus kilometers. Without more fiber, carriers will be unable to support the projected fourfold increase in mobile data traffic between 2016 and 2021.1 (See Figure 1.)

Figure 1. Illustrative view of deep fiber deployment.

Wireline broadband access supports as much as 90% of all Internet traffic even though the majority of the traffic ultimately terminates on a wireless device. However, 12 years after the first fiber-to-the-home deployments, only 38% of homes have a choice of 2 providers offering speeds of at least 25 Mbps.2 In rural communities, only 61% of the population have access to 25 Mbps wireline broadband, and when they do, they can pay as much as 3 times the premium over suburban customers.3

Future Investment Requirements

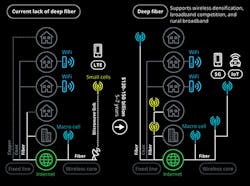

A Deloitte Consulting LLP analysis estimates that the US requires between $130 and $150 billion over the next 5-7 years to adequately support broadband competition, rural coverage, and wireless densification. Such ambitious infrastructure investment could derive from a variety of sources including communication service providers, financial investors, and public-private partnerships.

Our estimates include funding for 3 broad categories of fiber deployment: (See Figure 2.)

1. Fiber for wireless densification.

2. Fiber to increase consumer and business broadband competition.

3. Fiber to serve rural/underserved geographies.

Figure 2. Required fiber infrastructure investment.

Moreover, our model suggests massive synergies between the build required for wireless densification and adding broadband competition in urban areas. There are also additional benefits between densification and underserved communities. With more than 60% of total costs for construction, permits, and design,4 fiber providers may need to share Last Mile access routes and rights-of-way where possible in order to reach such synergies.

Currently, the wireline industry construct does not incent enough fiber deployment. Some wireline carriers are reluctant or unable to invest in fiber for the consumer segment despite the potential benefits. Expected wireline CapEx ranges between 14%-18% of revenue.5 Fiber deployment in access networks is justified today only if a short payback period can be guaranteed, a new footprint is being built, repairs from rebuilding after a storm or other event justify replacement or in subsidized geographies where Universal Service funds can be used.

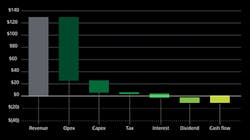

The largest wireline carriers spend, on average, 5-to-6 times more on operating expenses than capital expenditures.6 Excessive operating expenditures caused, in part, by legacy TDM network technology restrict carriers’ ability to leverage digital technology advancements. Worse, as legacy TDM networks continue to descale, the percentage of fixed costs overwhelms the cost structure, leading to even greater margin pressure. (See Figure 3.)

Figure 3. Average 2016 Wireline financials (in thousands of dollars).

In the last 5 years, wireline carriers have lost 7 points of market share in broadband access, mainly to cable operators, who have the advantages of a more modern coax network, do not have these legacy constraints, and have aggressively deployed high-speed broadband access using DOCSIS 3.0 and 3.1 upgrades. Cable operators currently cover more than 80% of US homes with Internet speeds of 25 Mbps or greater.6

Models to Encourage Deep Fiber Investment

Wireless, wireline, and cable require creative ways to monetize Last Mile access as an incentive for massive fiber deployment. Building an attractive business model is a start.

Consider these facts when examining the advantages of moving to a fiber-based IP network:

One study showed that there is a 60%-80% reduction in real estate and power costs when migrating to a fiber IP network because it allows carriers to remove equipment, repurpose floor space and even consolidate central offices.7

A survey by Nemertes Research shares these savings based on the change to a fiber-based IP network:

• Reduction in the average time to repair from 21 to 5 hours.

• Reduction in equipment maintenance expenses by 34%.

• Reduction of moves, adds and changes by 31%.

Deloitte proposed 3 models for improving our deep fiber efforts across the US.

Model 1: Synergies between deep fiber and adjacent services in an "unlimited" world

Gartner predicts that affluent households will have up to 500 connected devices by 2022.8 The number of devices and associated services provide an opportunity for carriers to grow ARPU beyond flat fees for unlimited bandwidth. According to Deloitte’s 2016 Global Mobile Consumer Survey, 75% of surveyed consumers indicate an interest in home-based IoT applications, while approximately 65% and 62% of surveyed consumers indicate an interest in automotive and wearables respectively. In some cases, IoT services offer the prospect of new revenue, however, most connected devices will likely require low bandwidth or will likely be Wi-Fi enabled and, therefore, may not provide carriers with incremental revenue. In such cases, carriers have an opportunity to increase revenue by offering integration, network security, and traffic management services, within the increasingly complex mix of IoT devices and ecosystems.

Most users want seamless performance despite using a mix of communications technologies. Relationships between hundreds of IoT devices and users are complex; most households or businesses have multiple occupants, making linkages between devices and environments difficult. Carriers are well-positioned to solve IoT integration needs.

Model 2: Partnership between carriers and OTT players to fund deep fiber.

Technology and over-the-top players have incentives to encourage deep fiber deployment. Many depend on a growing population of end users having sufficient bandwidth in their services at home, in the office, and on the go. As the disparity grows between the fiber available and the need for additional wireless densification and fiber broadband, over-the-top players may choose to fund fiber deployment. Funding can take the form of asset ownership or partnerships that provide funds to carriers for fiber builds in exchange for debt or equity. Regardless, it is difficult to meet objectives for deep fiber deployment without funding from players that constitute a large percentage of revenue from Internet-related services.

Model 3: Deep fiber a financial investment.

As regulatory, technology, and financial hurdles abate, the case for investment strengthens for financial players such as REITs and Communications Vendors and Tower Companies.

For example, increased use of high-frequency spectrum requires that in-building network coverage receive special attention. Fiber resident in building risers offers coverage and capacity solutions for carriers. Building owners and/or REITs can monetize existing or new fiber assets through carriers, or offer their own services to end users. Building owners can also extend their fiber assets to provide backhaul for outdoor small cells. This is just one example of how financial or other non-traditional players can invest to help fill the fiber gap.

As investment interest grows from non-traditional fiber investors, we can anticipate shared infrastructure to play a more prominent role in Last Mile fiber access. Wireless providers began by building and maintaining their own towers. However, as network coverage, capacity, and speed, became the bases of competition, they quickly switched to a more efficient, shared asset model for their physical infrastructure. Tower companies provided a mechanism for wireless carriers to share physical infrastructure while maintaining control of their radio access networks (RAN), providing significant synergies in real estate and maintenance costs.

The same opportunity may apply to deep fiber. Treating fiber as real estate investment leased to multiple carriers to maximize asset utilization can provide a mechanism for carriers to potentially reduce operational costs and help minimize capital requirements. High asset utilization combined with ecosystem monetization (discussed above) can provide investors with attractive returns. Financial investors or tower companies should consider deep fiber investment in tandem with carriers to achieve faster monetization and further secure returns.

Endnotes

1. Cisco Visual Networking Index Forecast. "Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2016–2021 White Paper," February 7, 2017.

http://www.cisco.com/c/en/us/solutions/collateral/service-provider/visual-networking-index-vni/mobile-white-paper-c11-520862.html

2. FCC Broadband Progress Report, January 29, 2016.

https://apps.fcc.gov/edocs_public/attachmatch/FCC-16-6A1.pdf

3. Deloitte analysis using GIS data, wire center boundary maps, and US census population data.

4. FTTH Europe Industry Council Report. "The Cost of Meeting Europe’s Future Network Needs," March 2017. http://ftthcouncil.eu/documents/Reports/2017/FTTH percent20Council percent20Cost percent20Model percent202017_final.pdf

5. Deloitte analysis using publically available company reports.

6. Deloitte analysis based upon annual report data.

7. "Verizon sees value in transforming network to IP, fiber, but conversion challenges remain," by Sean Buckley, Fierce Telecom, May 19, 2015.

http://www.fiercetelecom.com/telecom/verizon-sees-value-transforming-network-to-ip-fiber-but-conversion-challenges-remain

8. Deloitte analysis of publically available USAC annual reports.

This article is an excerpt from the report Communications infrastructure upgrade: The need for deep fiber. Deloitte. July 2017. Authors include: Dan Littman, Principal, Deloitte Consulting LLP; Craig Wigginton, Partner, Deloitte & Touche LLP; Phil Wilson, Managing Director, Deloitte Consulting LLP; Brett Haan, Principal, Deloitte Consulting LLP; and Jack Fritz, Sr. Manager, Deloitte Consulting LLP. Additional acknowledgements: Anthony DeFilippo, Illya Gerdes, Tim Krause, Drew Marx, Brett Olson, Renu Rao, Erica Sivertson, and Allison Smith. For more information about the report, please visit https://www2.deloitte.com/us/en/pages/consulting/articles/communications-infrastructure-upgrade-deep-fiber-imperative.html.

Save

Save

Save