Electric Utilities and The Future of Open Broadband

From the Smallest CO-OP to the Largest Public Utility —

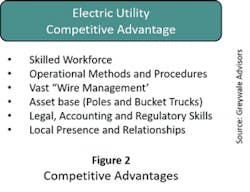

There’s an emerging understanding that broadband is critical civil infrastructure mandatory for community survival. It’s long been understood that electricity is critical civil infrastructure mandatory for community survival. In addition to this commonality, both broadband and electricity have much in common. Both rely on deploying and managing miles and miles of wires and cables running down the street either buried underground or hanging from utility poles.

Electric Co-Ops and Municipal Light Departments have been offering Internet Access over fiber for many years and more are beginning the process. The model has been to deploy fiber for "utility meter reading" and then, at near zero marginal costs, offer high speed Internet access. This may be clever, and very profitable, and in many rural areas it’s the only high-speed Internet Access game in town. However, in non-rural area this can have the effect of deepening the existing digital divide and creating a new one. This is not the future of broadband. It’s not fair to incumbent broadband providers or any other over-builder who can’t hide the huge fiber construction cost in an electric utility rate base.

Large Electric utilities have looked strategically at telecommunications for years. Previously, for the mass residential market that meant offering "Triple Play" services (Voice, Video and High-speed Internet). To an electric utility, or any new entrant, this is a major endeavor. In additional to deploying the fiber optic cables down the street they’d have to design, deploy, operate and maintain three separate infrastructures for voice, video and Internet. It didn’t matter whether they were going to be the second or third participant in the local market, the business models never worked.

Electric utilities and Co-Ops offering Internet Access in rural communities should be lauded in closing the current digital divide. Rural is a unique case for broadband as it was for electricity. The quantum leap opportunity is for big electric utilities in the rest of the country including suburban and dense urban.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022Broadband and Internet Access

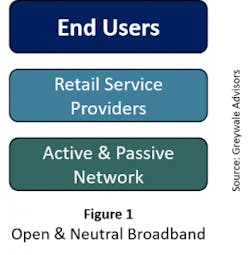

It’s important to understand that Internet Access and broadband are NOT synonymous. Broadband is infrastructure that ultimately connects end users to the nearest big city interexchange points. Internet Access is a service running on the infrastructure. Other broadband applications that are not Internet applications include local government VLANs (Virtual Local Area Network) and direct cloud access. This is an important distinction.

What’s different today?

The future of broadband is open and neutral. This means the network infrastructure is owned by one entity that wholesales parts of it to local and national brands. They, in turn, provide retail services to local residential and commercial subscribers. Thus, the electric utility can focus on deploying and managing a dispersed infrastructure that’s very similar to their existing one. They do not have to invest in service delivery infrastructures, new workforces and consumer retail service marketing.

In Ireland, SIRO is a $500 Million joint venture with the telecom company Vodafone and ESB a national power utility. They are leveraging ESB’s assets including substation real estate and underground and overhead infrastructure to deploy Fiber-to-the-Premise open access networks across Ireland. Other examples include Open Fiber in Italy and Reykjavik Fibre Network in Iceland. Italy’s Open Fiber is a wholesale-only joint venture between the Italian Utility ENEL and a Government financing organization. Reykjavik Fibre Network is owned by Reykjavik Energy, a multi-utility company providing services to tens of thousands of homes and businesses throughout Iceland.

Whether an Electric Utility’s Board of Directors choose to create a new business unit or a joint venture the general concept is this entity obtains funding and deploys fiber down the streets to every reasonable location in the entire town. Ducts and conduit can also be deployed where applicable providing an additional wholesale revenue opportunity and an easing of monopoly concerns.

This new entity could stop here and be a Fiber REIT (Real Estate Investment Trust) and lease dark fiber to retail service providers. However, this limits the economic and innovation impact of the open broadband infrastructure to both the electric utility and the community. Adding the lit layer will give you greater flexibility and create numerous new revenue streams by enabling new applications and services. The open broadband entity wholesales these to retail service providers who then, for example, deploy their own routers and offer "Internet Access". The lit model enables multiple retail service providers to deliver services to the same home or business at the same time over the same fiber. Whereas a dark fiber only model will proliferate today’s closed model of one provider per home.

Electric Utilities: A Natural Open Broadband Provider

Every community needs a modern broadband infrastructure for survival and there are only a few entities capable to provide it. They include the local phone company, the local cable company, the city itself, a pure play fiber new entrant (Overbuilder), the electric utility or some combination of them.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

Summary

Broadband has become critical civil infrastructure and every city and town in the world needs a modern broadband infrastructure to survive. The only question is who is going to provide it in each town. The electric utility industry is in a unique and enviable position to become the local broadband provider for cities and towns across the globe. The open and neutral broadband infrastructure model represents a quantum leap in the evolution of the electric utility. It’s the innovation that’s broken the code for the Electric Utility Industry.

About the Author