Recent updates include notices from ACG, Analysys Mason, Parks Associates, ABI Research, GlobalData, Tech Republic, DigitalBridgeK-12, and more. Visit https://isemag.com/category/safety/telecom-covid-19-network-impact-wireless-wireline/ often to find more COVID-19 Impact Updates.

The COVID-19 Inflection Point

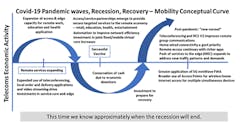

A recent blog from ACG, The Mobile Network Response to COVID-19, shares that companies succeed or fail on how they respond to market shifts. The impact of the COVID-19 virus and the accelerated shift from office-based work, education, and health services to home-based services caught most of the world by surprise.

This inflection point is happening now in 2 phases — the NOW response and LONG-TERM strategies — and represents a unique opportunity for the mobile telecom vendors to prepare for the new normal. Not all of the services shift will remain on fixed access, and the mobile industry needs to be prepared.

• Traffic shifts to fixed networks will partially return to mobile, with a different pattern.

• Data peaks are within network capability but are sustained over far greater times.

• Vendors must accelerate core and edge service focus.

• Core function distribution to the edge will accelerate.

• Vendors focused on efficient deployment and management of services will lead.

The disruptive opportunity that needs to be addressed is how to deliver the best solution and services for work from home, eHealth, eEducation, online retail, local servicing (food/grocery/supply delivery), and community communications.

Market share today does not guarantee market share tomorrow, especially after a major inflection point. Given the volatility in some markets as shown for the Mobile IP Edge for the past 2 years, vendors have to sharpen their vision of the new normal, and prepare for the next major event.

The ACG blog, The Mobile Network Response to COVID-19, is available at https://acgcc.com/blogs/2020/03/28/mobile-network-response-covid-19/.

COVID-19 Impact on Telecom

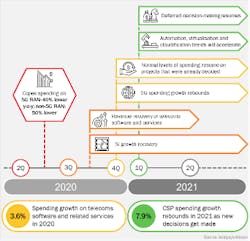

COVID-19 will have only short-term impacts on telecoms software and services vendors, according to a recent report by Analysys Mason.

Communications service provider (CSP) spending on telecoms software and related services will grow by 3.6% in 2020 as compared with our prior expectation of 6.7%.

The global shutdown had a severe impact in 2Q 2020, we expect a recovery in 3Q 2020, with close-to-normal spending levels returning in 4Q 2020. We expect CSP software and services spending to rebound in 2021 to 7.9% growth. The telecoms industry will be more robust than almost any other industry during this crisis.

Telecoms industry vendors will suffer short-term setbacks from COVID-19 as general shutdowns impede work and decision-making in 2Q 2020. However, the longer-term outlook for investment in the telecoms industry is positive, particularly in areas such as automation, virtualization and cloud enablement.

Key milestones in COVID-related telecoms software spending.

Source: https://www.analysysmason.com/Research/Content/Comments/covid-19-impacts-vendors/

Help! We Need Somebody!

Parks Associates forecasts total professional monitoring revenue for the US residential security sector will total $15.74 billion in 2020, with smart home services accounting for $1.2 billion.

Parks Associates notes the COVID-19 pandemic and resulting economic fallout create a more challenging landscape in 2020, specifically as consumers will look to reduce household spending. This exclusive survey revealed the following data:

• 29% of US broadband households own at least one smart home device, based on a comprehensive list tested in Parks Associates’ surveys.

• 33% of consumers who canceled their professional monitoring service did so because the monthly fee was too expensive.

• 70% of smart smoke/CO detector owners indicate interest in having their smoke detector connected to a professional monitoring service.

Source: IoT: Extending Professional Monitoring for New Revenue. www.parksassociates.com

City Governments Getting Smarter on the Fly

City governments are adjusting to a new reality, with COVID-19 driving urban resilience and digital transformation strategy agendas, finds global tech market advisory firm, ABI Research.

This is reflected in the deployment of a range of technologies for new use cases during the current emergency:

• Drones – Communication and enforcement of social distancing rules; delivery of medical supplies

• New types of surveillance – AI-based remote temperature sensing (Kogniz Health).

• Autonomous Freight – Autonomous Last Mile delivery (Beep, Navya, Nuro, Waymo, Postmates).

• Digital Twins – Holistic, transversal, real-time visibility for resources, assets, and services (Siradel).

• Real-time dashboards (City of Boston) and data sharing — including the use of smartphone data crowdsourcing for location tracking

"While many of the measures taken by city governments during COVID-19 are decided on the fly requiring high levels of improvisation, it has resulted in a rich laboratory type learning experience in terms of how to take advantage of the inherent flexibility of technologies to address emergency situations and challenges linked to demand-response management of assets and services," says Dominique Bonte, Vice President End Markets at ABI Research.

At the same time cities are reaping the benefits of a digital-only lifestyle in the form of the sudden adoption of e-Government services, e-Health and teleconsultation, remote work, online education, and e-Commerce, resulting in huge drops in traffic levels. These, in turn, are dramatically decreasing congestion, fatalities, and air pollution.

Importantly, post-COVID-19 traffic levels are expected to reach only between 80% and 90% of the pre-COVID-19 levels, as digital lifestyles take hold more permanently, driven by both public and private initiatives and incentives. The result will have lasting positive effects on the environment.

Source: Smart Cities and Smart Spaces Quarterly Update report. www.abiresearch.com

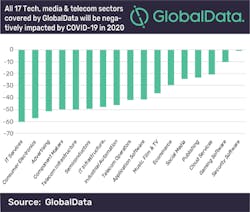

Tech Sector Stressor

COVID-19 is by far the most significant theme to affect the technology industry in 2020. It is effectively a stress test on companies’ abilities to cope with extreme shocks.

• COVID-19 will test the financial robustness of companies.

• There will be many consequences for the IT industry, some sectors of which will perform better than others.

• Some will fare relatively well in the short term, for example, collaboration software vendors and cloud services providers.

• Others — particularly IT infrastructure companies — may suffer short-term problems with their supply chains, but fare well in the future.

Source: https://store.globaldata.com/report/gdtmt-tr-m250–tech-media-telecom-trends-2020-thematic-research/

COVID-19 Congestion

Internet connectivity is crucial to successfully working and learning from home.

As COVID-19 spread across the world, use of video conferencing solutions and online collaboration tools have skyrocketed.

Nearly 40% of respondents said they noticed an uptick in Internet and/or cellular connectivity issues now that they and other relatives are sheltering in place. Before the coronavirus, 35% of people said they had networking issues, according to the report.

More than 82% of people said they don’t have a solution for fixing their Internet or connectivity issues, the report found.

Sources: www.techrepublic and https://digitalbridgek12.org

We’re Using Telehealth, and Want to Help With Contact Tracing

Parks Associates’ new research, COVID-19: Impact on Telehealth Use and Perspectives, finds over 50% of US broadband households are willing to share smartphone data to aid in COVID-19 contact tracing, while another 20% could be convinced provided privacy protections are in place.

The research tracks changes in consumer attitudes and adoption of telehealth services as a result of COVID-19, and measures future interest in telehealth services beyond the pandemic.

Additional data:

• Nearly half of consumers who used telehealth in the past 12 months report using a service offered by their local physicians’ practice.

• ~One-third of US broadband households used or attempted to use a telehealth service during the COVID-19 outbreak.

• Over half of US broadband households are willing to share smartphone data to aid in gathering information on COVID-19.

Source: Parks Associates’ research, COVID-19: Impact on Telehealth Use and Perspectives www.parksassociates.com