Monumentally Massive mMIMO

5G Network Densification to Drive Cellular Infrastructure Spending to US$191 Billion by 2026 —

Massive MIMO (mMIMO) is proving to be the catalyst that will fuel infrastructure vendor revenue in the foreseeable future. This is especially the case in the Asia Pacific, where mobile network operators are expected to deploy 28.3 million units representing more than 78% of the total mMIMO market by 2026, despite the banning of Chinese vendors in the Western World.

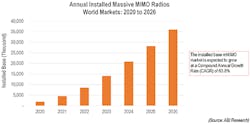

ABI Research’s report shared the installed base mMIMO market is expected to grow at a CAGR of 63.8% between 2020 to 2026 and reach US$58.2 billion by 2026. Furthermore, 5G densification and mMIMO will account for approximately 73% of the outdoor revenue reaching US$97.3 billion by 2026.

mMIMO enables Mobile Network Operators to offer the best-in-class service to end users while leveraging cell site infrastructure and spectrum assets acquired for 5G. The adoption of the different configurations depends on multiple factors such as user density, cell site characteristics, local regulations, and clutter features. For example, Chinese operators are deploying mMIMO radios mainly in 64T64R configuration, while in South Korea, operators are mainly deploying 32T32R mMIMO due to space and mast weight constraints.

In addition, in-building wireless will represent approximately 22% of the total mobile network infrastructure revenue in the world market, reaching US$34.4 billion by 2026. Protocols such as 5G NR-Unlicensed (5G NR-U), Citizens Broadband Radio Systems (CBRS), Licensed Shared Access (LSA), and locally licensed spectrum, will fuel the acceleration of small cell deployments in the enterprise domain.

Another exciting and innovative technology in the 5G era is Open RAN. The market dynamics of open RAN are affected by multiple factors. For example, the geopolitical environment that resulted in the ban of Chinese infrastructure vendors, the performance of existing open RAN networks, and technological developments, will affect the technology’s penetration across the different regions. However, it is expected that the revenue of the Open RAN market will grow at a CAGR of 126.7%, representing approximately 17.6% of the total outdoor revenue reaching US$ 23.6 billion by 2026.

Additional research highlights include:

• Shipments of Massive MIMO radios are expected to grow from 1.8 million in 2020 to a staggering 7.7 million in 2026, representing almost 30% of the global cell site footprint by 2026.

• Shipments of 5G baseband units grow are expected to grow from 1.093 million in 2020 to 3.5 million in 2026 with a CAGR of 21.7%.

• In-building wireless kit spending is expected to account for 22% of vendor revenues within the same period.

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022Resources and Notes

These findings are from ABI Research’s Indoor, Outdoor, and IoT Network Infrastructure market data report.

This report is part of the company’s 5G and Mobile Network Infrastructure research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, market data reports present in-depth analysis on key market trends and factors for a specific technology. For more information, visit https://www.abiresearch.com/market-research/service/5g-mobile-network-infrastructure/.

For more information, visit https://www.abiresearch.com/. You can also follow us on Twitter @ABIresearch.