Being on the 5G Edge Is HOT

Reducing 5G’s Energy Costs Would Be Super Cool —

Just 5 years ago, when we did a thought-leadership study asking industry thought leaders to look ahead to the data center of 2025, the edge of the network merited just 4 mentions in the final report, Data Center 2025 Report (2014).

Today, with the edge dominating conversation among data center professionals, that relative lack

of foresight seems unbelievable. And yet, that’s exactly how fast this network transformation has happened. Five years ago, the edge was an afterthought. Now, it’s the center of the data center universe, so to speak.

The increasing importance of the edge is changing the way today’s industry leaders think about the data center. The traditional enterprise data center — already adjusting to the proliferation of cloud and colocation facilities — today is evolving into more of a network hub, communicating and interacting seamlessly with resources located in colos, the cloud, or at the edge. The result is a broad data ecosystem comprised of many types of facilities, and relying increasingly on the edge of the network.

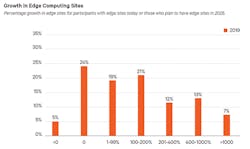

When we revisited Data Center 2025 earlier this year, the edge was top of mind for more than 800 data center professionals we surveyed. Of participants who have edge sites today or expect to have edge sites in 2025, more than half (53%) expect the number of edge sites they support to grow by at least 100%, and even that may undersell the coming rush to the edge. Consider this: 20% expect an increase of 400% or more. (See Figure 1.)

Figure 1. Growth in Edge Computing Sites

Understanding the Edge

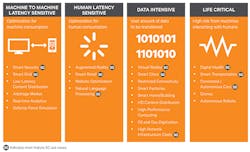

While a lot has been written and said about the edge of the network in recent years, there has been little agreement about exactly what that edge is. Our attempt to categorize edge deployments focused on emerging use cases at the edge, and led us to discover what we identified as 4 archetypes for those edge sites. (See Figure 2.)

Figure 2. 4 archetypes: Data Intensive, Human-Latency Sensitive, Machine-to-Machine Latency Sensitive, and Life Critical.

The 4 archetypes are:

Archetype 1: DATA INTENSIVE

This includes use cases where the amount of data makes it impractical to transfer over the network directly to the cloud or from the cloud to point-of-use due to data volume, cost, or bandwidth issues. Examples include smart cities, smart factories, smart homes/buildings, high-definition content distribution, high-performance computing, restricted connectivity, virtual reality, and oil and gas digitization. The most widely used example is high-definition content delivery (think HD video streaming, such as Netflix).

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 2022Archetype 2: HUMAN-LATENCY SENSITIVE

This archetype includes use cases where services are optimized for human consumption, and it is all about speed. Delayed data delivery negatively impacts a user’s technology experience, potentially reducing a retailer’s sales and profitability. Use cases include smart retail, augmented reality, website optimization, and natural language processing.

Archetype 3: MACHINE-TO-MACHINE LATENCY SENSITIVE

This includes the arbitrage market, smart grid, smart security, real-time analytics, low-latency content distribution, and defense force simulation. Because machines are able to process data much faster than humans, the consequences for slow delivery are higher than in the Human-Latency Archetype. For example, delays in commodities and stock trading, where prices fluctuate within fractions of a second, may turn potential gains into losses.

Archetype 4: LIFE CRITICAL

This archetype encompasses use cases that directly impact human health and safety. Consequently, speed and reliability are vital. Use cases include smart transportation, digital health, connected/autonomous cars, autonomous robots, and drones. Autonomous vehicles, for example, must have updated data to operate safely, as is the case with drones that may be used for e-commerce and package delivery.

Of course, these archetypes represent a snapshot in time, subject to change as demand shifts and technologies evolve. The next major development on that front appears to be 5G, which even in its fuzzy early days is driving considerable investment among providers and those who plan to leverage its capabilities.

The Reality of the Rush to 5G

It is hard to pinpoint exactly where the first 5G network was deployed. Ooredoo was the first major telecom provider to make the claim in May 2018, pointing to a small deployment on the east side of Doha in Qatar. South Korea made a similar claim earlier this year, and several US telecom providers have argued they were first.

Why does it matter? Simple: according to IHS Markit, 5G is expected to generate some $12.3 trillion in annual revenue by 2035. With that kind of market potential, there is an understandable race to deploy 5G, but the location of those deployments and how they’re built will depend on demand. Much of the discussion around 5G has been focused on some of its more ambitious applications, such as autonomous vehicles, but the near-term promises more incremental improvements over 4G services. When consumers and enterprises alike start to demand better Quality of Service (QoS) to run existing and new applications, operators will build the network to deliver that service level.

Vertiv recently commissioned a study of 5G progress and expectations with 451 Research, and the results indicate the early jostling among providers is a preview of a rush toward widespread 5G deployment. According to the survey, 12% of telecom operators expect to roll out 5G services this year, and a whopping 86% expect to be delivering 5G services by 2021. No one is easing into 5G. (See Figure 3.)

Figure 3. 45G Deployment Timeline

To make that timeline a reality, telcos must prepare now to successfully deploy and fully leverage 5G technologies. In some cases, that means sharp detours from technologies and architectures that emerged to support previous generations of cellular networks. The road from 3G to 4G to 5G is winding. Network architectures that supported 4G in some cases run counter to what we are seeing from early 5G deployments. C-RAN architectures, for example, evolved to support 4G by taking equipment from the base of a cell tower and centralizing it elsewhere to serve multiple sites. That made sense as a 4G strategy, but 5G is all about reduced latency and proximity to the consumer. That means more sites and more computing and IT infrastructure equipment at those sites.

What that looks like is an open question, but it’s likely we’ll see multi-access edge computing (MEC) architectures that bring cloud capabilities into the radio access network. That means physically deploying small, self-contained data center infrastructure systems within the operator network footprint, anywhere between the core and the edge of the network. In the survey, 37% of respondents said they are deploying MEC infrastructure ahead of 5G deployments, and another 47% intend to deploy MECs. These sites will be critical to network performance and functionality, and significant infrastructure investment and enhancements will be unavoidable.

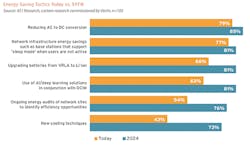

As more sites are deployed, there will be a corresponding increase in energy consumption — and 94% of those surveyed expect 5G to increase their overall energy costs. Telcos and equipment providers already are working across the network to mitigate those increases, focusing on everything from intelligent load management to innovations in cooling and environmental control. (See Figure 4.)

Figure 4. Energy Saving Tactics Today vs. 5YFN

Survey participants identified a number of strategies for dealing with the increase in energy consumption. Those strategies include:

• Reducing AC to DC conversions. 79% of participants say this is a focus today, and 85% say it will be a focus 5 years from now.

• New cooling techniques. 43% of telcos worldwide already have adopted new approaches to cooling to combat rising power and heat profiles, but 73% expect to be doing so in 5 years.

• Upgrades from VRLA to lithium-ion batteries. 66% of telcos say they are upgrading their batteries. 81% expect to do so within 5 years.

Bottom line: 5G is among the most disruptive network technologies and most difficult upgrades ever undertaken, requiring major changes to network architectures and upgrades to telecommunications, IT, and infrastructure equipment. And yet, the considerable effort is certainly worthwhile, because the possibilities 5G presents have the potential to radically transform and improve the world and our lives.

Like this Article?

Subscribe to ISE magazine and start receiving your FREE monthly copy today!

Resources and Notes

Data Center 2025 Report (2014). https://www.vertiv.com/en-us/about/news-and-insights/articles/pr-campaigns-reports/data-center-2025/data-center-2025-report/

Data Center 2025: Closer to the Edge. https://www.vertiv.com/en-us/about/news-and-insights/articles/pr-campaigns-reports/data-center-2025-closer-to-the-edge/

Defining Four Edge Archetypes and Their Technology Requirements. https://www.vertiv.com/globalassets/documents/white-papers/vertiv-edgearchetypes-wp-en-na-sl-11490_229156_1.pdf

The 5G economy: How 5G technology will contribute to the global economy. Economics & IHS Technology. Economic Impact Analysis, IHS Economics / IHS Technology. January 2017. https://cdn.ihs.com/www/pdf/IHS-Technology-5G-Economic-Impact-Study.pdf

ISE magazine, March 1, 2018. "C-RAN . . . But to Where?" By Jim Wiemer, https://isemag.com/2018/03/c-ran-but-to-where/

About the Author