The Global Impact of Wireless Innovation —

With completion of the first 5G standard in 2018, the wireless industry has taken another major step in transforming how people interact with the world. By supporting new types of applications and flexible use of spectrum, including frequencies never before used in cellular systems, 5G will provide the communications foundation for a future world of augmented and virtual reality, autonomous cars, smart cities, wearable computers, A.I., an everything-connected environment, and innovations not yet conceived.

4G LTE demonstrates how well wireless technology can support mobile and fixed broadband and Internet of Things (IoT), and it provides the foundation for 5G to massively augment capacity, increase throughput speeds, decrease latency, and increase reliability. 5G will not replace LTE; in most cases, the two technologies will be tightly integrated and co-exist through at least the late-2020s. Early deployments based on the recently completed first-phase 5G standard, emphasizing enhanced mobile broadband, will begin at the end of 2018. Adoption will accelerate in 2019, when the first 5G-capable smartphones emerge. The complete 5G standard, which adds support for items such as Industrial IoT, Integrated Access and Backhaul (IAB), and unlicensed spectrum, will become available in early 2020. Just as LTE continued to evolve throughout this decade, engineers will continue to enhance 5G.

Many of the capabilities that will make 5G so effective are appearing in advanced forms of LTE. With carrier aggregation, for example, operators have not only harnessed the potential of their spectrum holdings to augment capacity and performance, but the technology is also the foundation for entirely new capabilities, such as operating LTE in unlicensed bands.

With long-term growth in smartphone and other mobile device use limited by population, innovators are concentrating on IoT, which already encompasses a wide array of applications. Enhancements to LTE, followed by 5G IoT capabilities, will connect wearable computers, sensors, and other devices, leading to better health, economic gains, and other advantages. 5G not only addresses IoT deployments on a huge scale but also enables applications that depend on ultra-reliable and low-latency communications, sometimes called mission-critical applications, that were previously impossible.

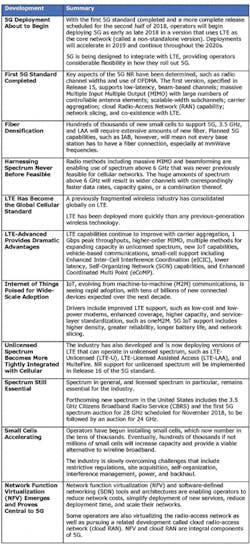

Figure 1. Most important wireless industry developments in 2018.

This article summarizes some of the most important advances for 5G progress occurring in 2018. (See Figure 1.)

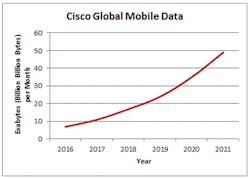

Figure 2. Global Mobile Data 2016 to 2021 (3)

Figure 2 shows the often-cited Cisco projection of global mobile data consumption through 2021, measured in exabytes (billion gigabytes) per month, demonstrating traffic growing at a compound annual rate of 47%.10 What’s more, the number of 5G connections will grow rapidly: GSMA estimates 1.2 billion connections by 2025.11 (See Figure 3.)

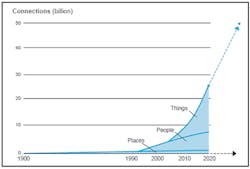

Figure 3. Cisco projects 3.3 billion IoT connections by 2021, with 6% on 2G cellular, 16% on 3G, and 46% on 4G. (6)

As imagined, the economic role that wireless technology plays keeps increasing. One study anticipates that in 2035, 5G will enable $12.3 trillion of global economic output.15

InvisiLight® Solution for Deploying Fiber

April 2, 2022Go to Market Faster. Speed up Network Deployment

April 2, 2022Episode 10: Fiber Optic Closure Specs Explained…

April 1, 2022Food for Thought from Our 2022 ICT Visionaries

April 1, 20225G Arrives — The Chronology

3GPP completed the first 5G specification in early 2018, enabling standards-based networks to be deployed in the 2019-2020 timeframe, with some operators even planning deployment in late 2018.

Although the industry is preparing for 5G, LTE capabilities continue to improve in LTE-Advanced Pro. Given the scope of global wireless infrastructure, measured in hundreds of billions of dollars, offering users the most affordable service requires operators to leverage investments they have already made. Thus, most operators will exploit the benefits of combining 4G and 5G technologies, such as using 4G for coverage and 5G for enhanced performance.

Figure 4. Timeline of Cellular Generations

Figure 4 presents the timeline of technology generations, including past and future, showing initial deployment, the year of the peak number of subscribers, and decline. Each cellular generation spans multiple decades, with peak adoption occurring some 20 years after initial deployment. 6G deployment in 2030, though highly speculative, is consistent with deployment of previous generations.

At a high level, 4G provides a foundation of capability and knowledge on which 5G will grow. Because each generation of cellular technology is more efficient, the cost of delivering data decreases, and so prices are lower for users, expanding the number of feasible applications. The same will be true with 5G, as analyzed in an Ericsson report. The report states, "A site fully evolved with 4G and 5G capacity will deliver mobile data 10 times more cost efficiently than a basic 4G site does today." Similarly, an analyst firm predicts that the cost of delivering a gigabyte of data will drop from $1.25 with 4G to $0.16 with 5G.21

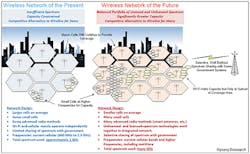

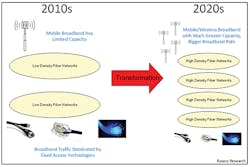

Finally, Figure 5 shows the transformation of networks, moving from LTE-Advanced networks to LTE-Advanced Pro and 5G networks.

Figure 5. Network Transformation (26)

The future of wireless technology, including both LTE-Advanced and 5G, is bright, with no end in sight for continued growth in capability, nor for the limitless application and service innovation that these technologies enable.

This article has been adapted from the whitepaper LTE to 5G: The Global Impact of Wireless Innovation, by Rysavy Research and 5G Americas, August 2018. For more information and to download the white paper, please visit http://www.5gamericas.org/files/4915/3479/4684/2018_5G_Americas_Rysavy_LTE_to_5G-_The_Global_Impact_of_Wireless_Innovation_final.pdf.

5G Americas is an industry trade association serving as the voice of LTE and 5G throughout the Americas. The association frequently publishes white papers and reports, deployment data and other resources on the mobile cellular industry at www.5GAmericas.org. Twitter: @5GAmericas

Endnotes and Additional Resources

1. Although many use the terms UMTS and WCDMA interchangeably, in this paper WCDMA refers to the radio interface technology used within UMTS, and UMTS refers to the complete system. HSPA is an enhancement to WCDMA.

3. Cisco, Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2016-2021, February 2017.

6. Cisco, Cisco Visual Networking Index: Global Mobile Data Traffic Forecast Update, 2016-2021, February 2017.

10. Ericsson, Ericsson Mobility Report, June 2018.

11. GSMA, "GSMA Publishes New Report on 5G Network Slicing & Business Opportunities," Nov. 20, 2017. Available at https://www.gsma.com/futurenetworks/digest/new-5g-network-slicing-report/.

15. IHS Economics and IHS Technology, The 5G Economy: How 5G Technology will contribute to the global economy, January 2017. Commissioned by Qualcomm Technologies. Available at https://cdn.ihs.com/www/pdf/IHS-Technology-5G-Economic-Impact-Study.pdf.

16. BroadbandBreakfast.com, "Wireless Internet Service Providers Pitch Fixed Wireless Technology in Forthcoming Infrastructure Bill," Oct. 2017, available at http://broadbandbreakfast.com/2017/10/wireless-internet-service-providers-pitch-fixed-wireless-technology-in-forthcoming-infrastructure-bill/.

17. Details at https://datacommresearch.com/reports-broadband/.

18. The ITU hotspot capacity requirement of 10 Mbps/sq. m. is equivalent to 10 Tbps/sq. km. See also Nokia, Ten key rules of 5G deployment, Enabling 1 Tbit/s/km2 in 2030, 2015.

21. Fierce Wireless, "Industry Voices — Madden: 5G investment won’t happen with net neutrality," Dec. 13, 2017. Available at https://www.fiercewireless.com/5g/industry-voices-madden-5g-investment-won-t-happen-net-neutrality.

24. Per 3GPP TR 38.913 (V14.2.0, Mar. 2017), 0.5 msec for DL and 0.5 msec for UL for URLCC and 4 msec for UL and 4 msec for DL for eMBB.

25. For example, see Ericsson, An overview of the IMT-2020 Evaluations, R1-1806431, May 2018. Intel, Initial Results for IMT-2020 Self-Evaluation, R1-1804758, May 2018. Nokia, IMT-2020 self-evaluation: Initial UP latency analysis, R1-1807288. Nokia, Spectral Efficiency Results for the IMT-2020 Self- Evaluation, R1-1807284, May 2018. These 3GPP contributions are available at https://portal.3gpp.org/ngppapp/TdocList.aspx?meetingId=18784.

26. See also Rysavy Research infographic, "Mobile Broadband Networks of the Future," April 2014. Available at https://rysavyresearch.files.wordpress.com/2017/08/2014-05-networks-of-the-future-infographic.pdf.

31. For a further discussion of 5G capacity and ability to compete with wireline networks, refer to Datacomm Research and Rysavy Research, Broadband Disruption: How 5G Will Reshape the Competitive Landscape, 2017, available at https://datacommresearch.com/reports-broadband/.

32. Note that schedules shown are based on Abstract Syntax Notation One (ASN.1) completion, meaning the specifications are fully complete. Stage 3 completion of specifications is when features are frozen and precedes ASN.1 completion by a typical three months.

[toggle title=”5G and Fixed Wireless Access” load=”hide”]As wireless capability has improved, many applications that previously used wired connections have shifted to wireless connections. Examples include wireline telephony moving to mobile telephony, Ethernet to Wi-Fi, and now Digital Subscriber Line (DSL) and coax cable to fixed wireless and satellite systems. Particularly in rural areas, wireless technologies can be built at a fraction of the cost of wired networks, extending broadband to more people.

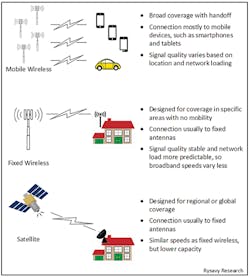

A board member of the Wireless Internet Service Provider Association stated that wireless costs are one fifth to one tenth that of cable or fiber.16 Figure 6 shows the characteristics of three forms of wireless connections, including mobile wireless, fixed wireless, and satellite. Fixed wireless connections have more stable connections and predictable load than mobile wireless connections, so broadband speeds vary less.

Figure 6. Types of connections.

Broadband networks rely on a fiber core with various access technologies, such as fiber to the premises, coaxial cable, digital subscriber line (DSL), or wireless connections. LTE provides a broadband experience, but capacity limitations prevent it from being the only broadband connection for most users. As a result, a majority of consumers in developed countries have both mobile broadband and fixed broadband accounts.

Two developments will transform the current situation:

1. Fiber Densification. Multiple companies are investing to extend there reach of fiber, decreasing the distance from the fiber network to the end node.

2. 5G Standardization and Deployment. As 5G mmWave technology, including massive MIMO and beamforming, becomes commoditized, it will increasingly be a viable alternative to fixed-access technologies such as coaxial, DSL, and even fiber connections.

Consequently, the companies that provide broadband service may change, and eventually, fixed and mobile broadband services may converge.

Figure 7 shows the emerging broadband network is one with denser fiber and competing access technologies in which wireless connectivity plays a larger role.

Figure 7. Fiber densification with Multiple Access Technologies, including mmWave.

Rysavy Research analysis also shows that mmWave networks can compete with or even exceed the capacity of Hybrid Fiber Coaxial (HFC) networks, although HFC networks can also densify to increase capacity. Densifying either a mmWave network or HFC network means moving fiber closer to homes. With access to comparable amounts of spectrum and similar spectral efficiencies, mmWave networks and HFC networks will achieve similar capacity relative to the distance of fiber from the endpoint.

LTE and 5G will also play an important role in rural broadband, with a variety of spectrum bands coming into service. Cellular operators, whose licenses for spectrum are driven by urban capacity demands, may have lightly used spectrum assets in less dense areas that they could use for fixed wireless service. Unlicensed 5 GHz bands will also continue to play a role. The band gaining the most attention, however, is CBRS, which spans from 3.55 to 3.70 GHz. These lower frequencies are ideal for rural broadband. The Federal Communications Commission is still finalizing rules, and under debate is the size of license areas for priority access licensees. Mobile operators prefer larger license areas, called Partial Economic Areas (PEAs), while smaller WISPs prefer licenses for much smaller areas, called census tracts.[/toggle]